The era of refined management in large asset management.

Yiming.com Baiming Plan Special Paper (Article | Qian Ren):After experiencing a rough development and sales model, commercial real estate has gradually entered the era of large-scale asset management with refined management of overall project ownership. This also means that there is an increasing demand for the ability of asset management and operation personnel, as the individual's asset management and operation ability will directly determine the revenue and investment return of assets. In the past, traditional asset management relied heavily on the experience of management teams, and decision-making was based on past experience and market fuzzy predictions, which could not be exhausted; If there is a judgment error in the asset management process, it will lead to asset revenue loss and revenue risk. Technology asset management is the collection of internal and external data through technological means, and the use of algorithmic models for risk assessment and early warning. It helps asset managers reduce decision-making risks, improve asset management efficiency, and achieve an increase in asset revenue and value.

When it comes to commercial real estate technology companies, VTS in the United States can be considered a unicorn. It is empowering the commercial real estate industry through the use of internet technology, enabling asset holders to make intelligent, data-oriented decisions. This trend has also spread in China, and many technology enabled commercial real estate technology companies have emerged, including Shazamtech.

The Digital Transformation of Commercial Real Estate Asset Management

Consistent with VTS, VTS co founders Ryan Masiello and Nick Romito worked as commercial brokers in New York for nine years before their establishment. Their past industry experience has made them very clear about their own problems to solve; And Hailang Liu, CEO of Shazamtech, is a former partner of Shanghai Re/Max Real Estate Consulting Co., Ltd. He has more than ten years of service management experience in the frontline real estate field and is also deeply familiar with the pain points at the bottom of domestic commercial real estate circulation.

The goal is to increase the value of assets, which must focus on the underlying perspective of asset leasing and circulation, and directly enhance the value of project assets through technological means. In this way, more than ten years of frontline work experience will appear very valuable.

Otherwise, by implementing KPI management indicators from the top level through the IT system, it means empowering management. Overmanagement, on the other hand, can make the frontline personnel of commercial real estate truly responsible for the company's revenue suffer unbearably, reduce organizational efficiency, and have a negative impact on asset operations.

Shazamtech focuses on the innovation and application of artificial intelligence, Internet of Things technology, and internet technology in the field of commercial real estate asset management, using technological means to help professional asset managers manage commercial real estate assets and enhance their value.

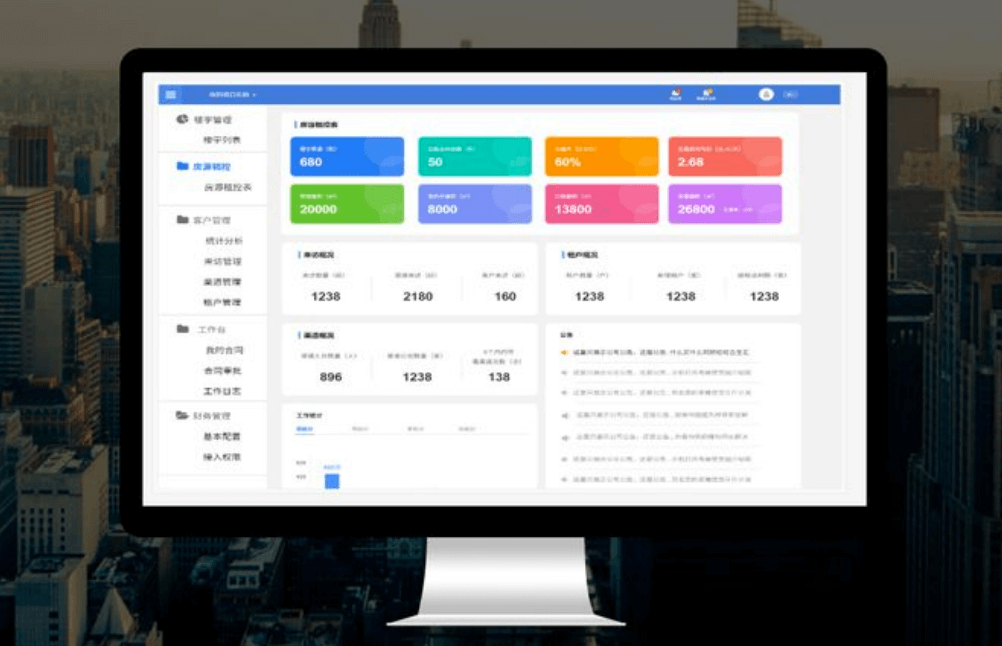

According to Hailang Liu, its core product, the SaaS solution for digital transformation in the commercial real estate industry, is dedicated to this. This solution helps commercial real estate holders bid farewell to the era of EXCEL or paper-based asset management in real estate, and provide full scenario services such as investment management, tenant management, financial management, customer management, and property facility equipment management, which will improve efficiency and reduce asset management costs simultaneously.

That is to say, relying on powerful customer data analysis functions, asset managers can real-time grasp the rental status of buildings, monitor contract lease terms, help advance investment promotion work, reduce building vacancy rates and periods, and solve the problems of slow investment promotion, disorderly management, and difficult rent collection under traditional asset management models in the past.

And for the refined operation of tenant management, Shazamtech has provided a solution of ‘Life of Everything’. What is ‘Life of Everything’? The process of everything from few to many, from simple to complex, connects property owners, property managers, enterprises, tenant personnel, and the building itself in the entire building ecosystem, giving its owners the same perception, self judgment, and analytical abilities. Ultimately, the value brought by these behaviors is reflected in the financial statements of asset managers.

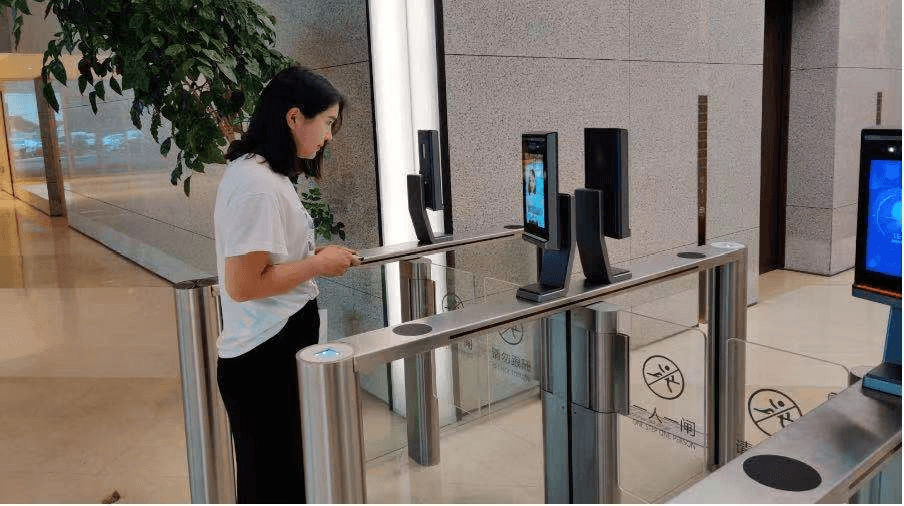

It is reported that the tenant management solution has two core functions: one is the application of facial recognition graphics processing technology in the intelligent upgrade of office buildings, and the other is the prediction of tenant rental behavior based on data analysis and specific algorithms. The two have a certain probability of intelligently judging the performance of tenants, forming risk control over tenants, actively warning and taking early action to minimize tenant turnover, reduce vacancy losses in project units, and improve the net operating income of the project.

This is a product derived from technological progress, combining traditional asset management with technology, giving birth to a new category - technology asset management. However, in China, technology asset management is still a brand new field that needs to be explored. Hailang Liu believes that this will be an excellent development opportunity for Shazamtech, and its development goal is to become the ‘Chinese version VTS’.

The Value of Technology Asset Management

Whether in terms of the gradually mature commercial development pattern of the industry or the improvement of technology driven efficiency, the technology asset management of commercial real estate is inevitably the trend.

In the past, China's commercial real estate market was mainly an incremental market for development and sales; Nowadays, we have entered the second half of the stock era. That is to say, the current inventory pressure of real estate is very high, and it has gradually moved from the previous ‘Product Is the King’, ‘Channel Is the King’, and ‘Configuration Is the King’ to the ‘Operation Is the King’ stage.

In addition, the life cycle of commercial real estate includes five links: ‘Investment, Financing, Construction, Management, and Retirement’. Among them, ‘Management’ refers to asset management, which occupies the vast majority of the entire life cycle of buildings, which determines that ‘Asset Management’ must be the top priority.

Throughout the existing life scenarios, smart buildings, IT system construction, and property informatization are all serving asset management to a certain extent, all in order to serve customers well and improve asset revenue capabilities; However, it is not entirely the same. Hailang Liu stated that technology asset management is not equivalent to a pure real estate IT system, and whether compared from multiple aspects such as design ideas, product value, data sources, end users, decision drivers, etc., there are significant differences between the two.

At the design concept level, the real estate IT system is a KPI perspective from top to bottom, achieving goals through assessment, and strengthening management through IT means, which belongs to management empowerment. Technology asset management is a bottom-up perspective based on OKR, and focuses more on the project assets themselves, which is technology empowerment;

At the level of product value, the real estate IT system is to achieve paperless informatization and digitization, while technology asset management is to enhance asset value;

At the level of data sources, the real estate IT system requires manual data entry, and the methods and methods are still too traditional. The technology asset management data comes from IoT equipment, third-party data and algorithm model data, as well as a very small amount of manual data;

At the user level, the decision-making users of the real estate IT system are the boss, and the end users are employees. However, the fact is that the vast majority of frontline employees who contribute to asset revenue in companies do not want to use software that is not helpful for work indicators, and it takes time and effort to meet management requirements. This is also the reason why many commercial real estate companies spend high prices to create an IT system, but the frequency of use is extremely low, and even give up.

In summary, what technology asset management needs to do is not to solve internal IT system problems for customers, but to solve asset value problems for customers.

As for its necessity, Hailang Liu shared a set of data with www.ymtmt.com. Taking an office building located in the inner ring of Shanghai, which is often worth billions of RMB, as an example, if the net operating income can be increased by 1% through technology asset management, and then the value can be quantified using financial tools, its economic benefits can even reach the level of tens of millions, and its value is very significant.

An Increasingly Prosperous Industry Environment

This will be a blue ocean market full of opportunities, Hailang Liu firmly believes, and more discerning individuals will also know early on. So a group of commercial real estate asset management companies emerged that were doing the same thing as Shazamtech, but faced with homogeneous competition in the industry, Hailang Liu was calm.

He stated that the first advantage is the application of new technologies. More and more algorithm models and tool technologies are being opened up, while underlying technologies such as cloud computing and the Internet of Things have been monopolized by internet giants. For startups, the focus and barriers of their products lie not in the technology itself, but in the implementation of the technology in the scene. The application of new technologies can truly create value, which is very important. This is the threshold for the implementation of technology applications. You must understand both technology and application scenarios.

Secondly, the advantage of product innovation. A new product will open up a segmented or brand new market, and the overall commercial real estate technology asset management track is relatively new. There are still many areas to explore, and the innovation ability of the product will be important for the company's revenue growth, which will also become a competitive advantage.

Furthermore, industry experience and resource accumulation. Shazamtech's founding team has over ten years of industry experience and resource accumulation in the industry, able to respond quickly to project needs, provide accurate and constructive solutions in a timely manner, and provide full lifecycle management services for commercial real estate clients, occupying a certain market share. It is understood that its core members come from technology experts in the research and development field of the banking and financial system, as well as partners in Silicon Valley Technology Hardware Entrepreneurship Company in the United States.

Of course, in addition to the endless emergence of professional commercial real estate technology enterprises, there are also well-known real estate developers entering, and even internet giants such as Tencent and Alibaba have been involved.

But Hailang Liu believes that most of the current entrants are transitioning from the internet to developing digital software that goes beyond Excel spreadsheets, rather than focusing on using technology to enhance asset value. In addition, the market competition pattern has not yet formed, so he has great confidence in the information security, technology feasibility, and application scenarios of Shazamtech products. After all, ‘professional things still need professional people to do’.

Perhaps for the current domestic market, commercial real estate technology asset management is still in its infancy, but this is inevitably the trend. From embryonic to widespread, Hailang Liu has given a time limit of about five to ten years.